As a cat owner, you know how much joy and companionship your feline companion brings into your life. From purring on your lap to the occasional playful mischief, cats make our lives brighter. However, just like with any pet, unexpected accidents or health issues can arise that may leave you with large veterinary bills. This is where cat insurance comes in, providing you with financial peace of mind should the unexpected happen.

As a cat owner, you know how much joy and companionship your feline companion brings into your life. From purring on your lap to the occasional playful mischief, cats make our lives brighter. However, just like with any pet, unexpected accidents or health issues can arise that may leave you with large veterinary bills. This is where cat insurance comes in, providing you with financial peace of mind should the unexpected happen.

In this blog post, we’ll dive into everything you need to know about cat insurance, including why it’s a great idea, what’s covered, and how to choose the best policy for your pet.

What Is Cat Insurance?

Cat insurance is a policy designed to help cover the cost of medical care for your cat. It can cover a variety of things, including emergency treatments, surgeries, medications, and even routine care like vaccinations or flea treatments, depending on the plan you choose. Think of it as a safety net for your cat’s health, allowing you to provide them with the best possible care without worrying about skyrocketing veterinary expenses.

Why Should You Consider Cat Insurance?

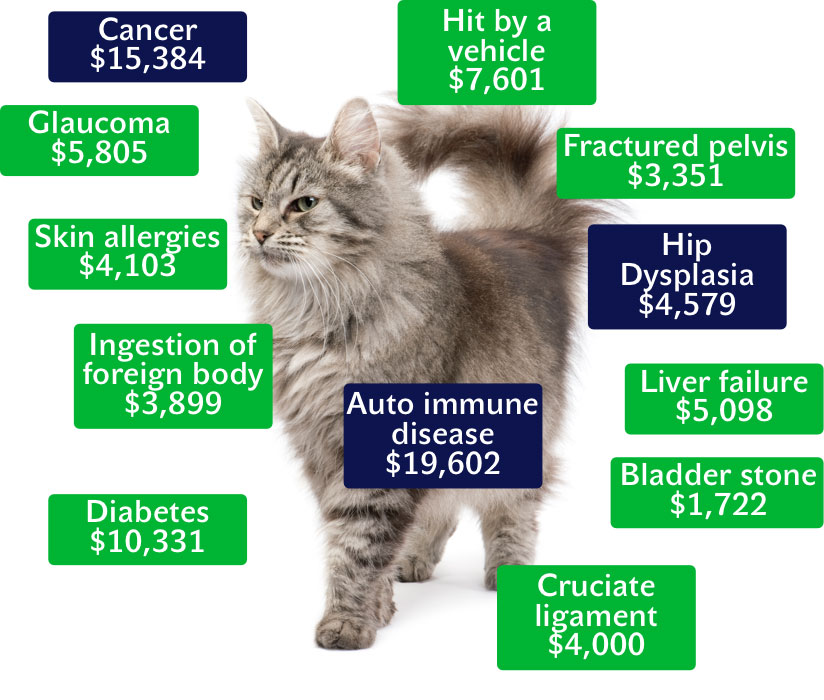

- Unexpected Vet Bills: Cats are often curious, which can lead to accidents or illnesses that require urgent care. Whether it’s a swallowed object, an infection, or a chronic condition, vet visits can be costly. With insurance, you’ll have help covering these expenses.

- Peace of Mind: Life with a cat can be unpredictable, and knowing you’re covered for unexpected medical issues can take a lot of stress off your shoulders. Whether it’s a sudden illness or an accident, you can focus on getting your cat the best care, without worrying about how to pay for it.

- Preventive Care: Some insurance plans include coverage for wellness exams, vaccinations, flea treatments, and other preventive measures. By taking proactive steps to keep your cat healthy, you can avoid costly medical conditions down the road.

- Rising Veterinary Costs: Veterinary services are becoming more expensive as technology and treatments improve. Advanced tests, surgeries, and medications are great for your cat’s health, but they can be expensive. Pet insurance helps to keep these costs more manageable.

Types of Cat Insurance

Not all pet insurance plans are the same, so it’s important to understand the different types of coverage available for your cat. Here are some common options:

- Accident-Only Coverage: This is the most basic form of cat insurance. It covers injuries caused by accidents such as falls, vehicle accidents, or poisoning. While it’s affordable, it doesn’t cover illnesses or routine care.

- Accident and Illness Coverage: A more comprehensive plan, this covers both accidents and illnesses. From infections to chronic conditions like kidney disease or arthritis, this option offers more protection for your cat. It’s a great choice for those who want broader coverage.

- Comprehensive Coverage: This plan offers the most extensive coverage, including accidents, illnesses, and often wellness and routine care like vaccinations and dental checkups. It’s ideal for those who want complete coverage for their cat’s health.

- Wellness Plans: Some insurance companies offer wellness add-ons that cover routine care. These plans are separate from the basic insurance policy but can be a good option if you want to keep your cat’s preventive care covered.

What Does Cat Insurance Cover?

Each pet insurance policy varies, but generally, cat insurance can cover the following:

- Accidents: Injuries from accidents, such as broken bones, cuts, or ingested foreign objects.

- Illnesses: Diseases or conditions like infections, diabetes, cancer, or urinary tract infections.

- Surgeries: Surgical procedures that are needed to treat injuries or illnesses.

- Diagnostic Tests: Blood tests, X-rays, MRIs, ultrasounds, and other tests used to diagnose conditions.

- Emergency Care: Coverage for unexpected trips to the emergency vet.

- Medications: Prescription medications for ongoing conditions or treatments.

- Chronic Conditions: Ongoing treatments for long-term conditions like arthritis or heart disease.

Some plans may also cover behavioral treatments, alternative therapies (e.g., acupuncture), and boarding fees if your cat is hospitalized.

What’s Not Covered by Cat Insurance?

While cat insurance can be very helpful, there are some common exclusions to be aware of. Most insurance policies do not cover:

- Pre-existing Conditions: Any health issues your cat had before getting insurance typically won’t be covered.

- Routine Care (unless specified): Not all policies cover wellness visits, vaccinations, or annual check-ups unless you’ve purchased an additional wellness plan.

- Cosmetic Procedures: Non-essential surgeries like tail docking, declawing, or ear cropping.

- Breeding or Pregnancy-Related Issues: Most insurance providers do not cover breeding costs or pregnancy complications.

- Age Limitations: Older cats may face higher premiums or limited coverage, and some insurers may refuse to cover pets over a certain age.

How Much Does Cat Insurance Cost?

The cost of cat insurance varies based on several factors, including your cat’s age, breed, and health history. On average, cat insurance premiums range from $15 to $40 per month. However, here are some factors that influence the cost:

- Age: Older cats are more likely to develop health problems, which can lead to higher premiums.

- Breed: Some breeds are more prone to certain health conditions, and insurers may adjust premiums accordingly.

- Coverage Type: The more comprehensive the coverage, the higher the cost. Accident-only policies will be cheaper than comprehensive ones.

- Location: The cost of veterinary services varies depending on where you live. If you’re in an area with higher vet fees, your premiums may be higher.

You can also choose your deductible and reimbursement level, which can affect how much you pay each month. A higher deductible may lower your monthly premium, but you’ll pay more out-of-pocket when you need to make a claim.

How to Choose the Right Cat Insurance Plan

Choosing the best cat insurance plan can be overwhelming with all the options available. Here are some tips to help you make the right choice:

- Evaluate Your Cat’s Health: If your cat is young and healthy, a basic accident-only policy might be enough. However, for older cats or those with health issues, a more comprehensive policy is likely the better choice.

- Compare Providers: Take time to research different pet insurance companies. Compare coverage options, exclusions, premiums, and customer reviews to find the best fit.

- Check the Fine Print: Be sure to read the terms and conditions carefully. Understand what is and isn’t covered, the waiting periods, and any other limitations.

- Consider Your Budget: Make sure the policy you choose fits within your budget. While you want to ensure your cat has the best care, the monthly premiums should be manageable for you.

- Look for Flexible Plans: Some insurers allow you to add or remove coverage options, so look for flexibility in your plan to adjust as your cat’s needs change.

Final Thoughts

Cat insurance is an excellent way to ensure that your feline friend receives the best possible care without breaking the bank. By having insurance in place, you can focus on what truly matters—your cat’s health and happiness—knowing that unexpected veterinary bills won’t throw your finances off balance.

If you haven’t considered cat insurance yet, it might be time to explore your options. With a wide variety of plans available, you’re sure to find one that suits both your budget and your cat’s needs.

Have you already enrolled your cat in an insurance plan? Share your experience or any questions you may have in the comments below!