Dogs are often considered family members, and for good reason—they offer unconditional love, loyalty, and joy every day. However, just like humans, dogs can experience unexpected health issues or accidents, which can lead to costly veterinary bills. As a pet owner, the last thing you want is to make tough decisions about your dog’s health based on financial concerns. That’s where dog insurance comes in, providing a safety net that helps cover the costs of unexpected vet visits, surgeries, and treatments.

In this blog post, we’ll explore why dog insurance is a smart choice for pet owners, the different types of coverage available, and how to choose the best plan for your dog’s health and your peace of mind.

What Is Dog Insurance?

Dog insurance is a policy that helps cover the cost of medical care for your dog. Depending on the plan, it can include coverage for accidents, illnesses, surgeries, medications, and even wellness care such as vaccinations and check-ups. It’s designed to protect your dog’s health while helping you manage the financial burden of veterinary care, which can often be expensive.

Why Should You Get Dog Insurance?

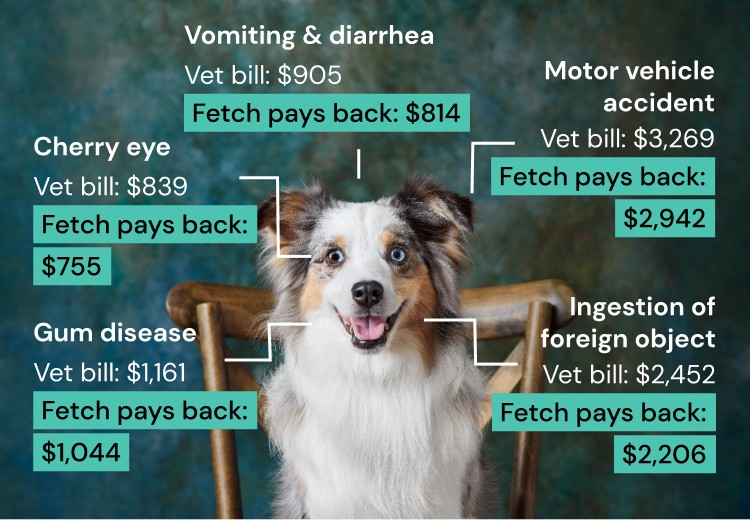

Unexpected Vet Bills: One of the biggest reasons to invest in dog insurance is to protect yourself from the high cost of unexpected vet bills. Whether your dog is involved in an accident or develops a medical condition, emergency care can be expensive. Dog insurance helps ensure that you don’t have to choose between your pet’s health and your bank account.

Peace of Mind: Knowing that you have financial support for your dog’s medical care gives you peace of mind. When your dog is sick or injured, you can focus on their recovery instead of worrying about how to pay for treatment. Insurance allows you to make the best decisions for your dog’s health without stressing over costs.

Rising Veterinary Costs: Veterinary care costs have been steadily increasing, especially with advancements in medical technology and specialized treatments. What may seem like a routine vet visit can quickly turn into a large financial expense. Pet insurance helps mitigate the impact of rising veterinary costs by covering a portion of the bill.

Chronic and Preventive Care: Some dog insurance plans cover not only accidents and illnesses but also routine care, including vaccinations, flea treatments, and even dental cleanings. This can help you keep your dog healthy and prevent future health problems that could be costly to treat.

Types of Dog Insurance

There are several different types of dog insurance policies to choose from, and it’s important to find the one that best fits your dog’s needs. Here are the most common options:

Accident-Only Coverage: This is the most basic form of pet insurance. It covers injuries caused by accidents, such as broken bones, cuts, or swallowed objects. Accident-only policies are typically the most affordable but do not cover illnesses or preventive care.

Accident and Illness Coverage: This more comprehensive plan covers both accidents and illnesses, such as infections, cancer, and genetic conditions. It’s the most popular choice for pet owners because it offers a broader range of protection for your dog.

Comprehensive Coverage: A comprehensive policy provides coverage for accidents, illnesses, and sometimes preventive care like vaccinations, wellness exams, and flea treatments. While it’s typically more expensive, it’s the most complete option and can offer long-term value by covering both unexpected and routine care.

Wellness Plans: Some insurers offer wellness plans as an add-on to traditional pet insurance. These plans cover routine care and preventive treatments, such as vaccinations, spaying/neutering, flea/tick prevention, and dental care. Wellness plans can be a good option if you want to ensure your dog’s long-term health.

What Does Dog Insurance Cover?

Coverage can vary from one insurance provider to another, but typical policies will cover the following:

Accidents: Injuries resulting from accidents like falls, car accidents, or swallowing foreign objects.

Illnesses: Conditions like infections, cancer, allergies, or chronic diseases such as diabetes or arthritis.

Surgeries: Operations that may be necessary due to injuries or health problems.

Diagnostic Tests: X-rays, blood tests, MRIs, and ultrasounds that are used to diagnose conditions.

Emergency Care: Coverage for emergency visits, including after-hours care.

Medications: Prescription medications for treating illnesses, injuries, or chronic conditions.

Chronic Conditions: Long-term treatments for ongoing health problems, like cancer treatments, arthritis management, or heart disease.

Some plans may also cover alternative treatments like acupuncture or physiotherapy, as well as behavioral therapy for issues like separation anxiety or aggression.

What’s Not Covered by Dog Insurance?

While dog insurance is valuable, there are a few exclusions to keep in mind. Common exclusions include:

Pre-Existing Conditions: Health conditions that your dog had before getting insurance are typically not covered.

Routine Care (unless specified): Many insurance policies do not cover routine veterinary visits, vaccinations, or annual check-ups unless you purchase a wellness plan.

Cosmetic Procedures: Treatments that are considered non-essential, like grooming or tail docking, are generally not covered.

Breeding and Pregnancy-Related Issues: Most policies exclude expenses related to breeding, pregnancy, or childbirth.

Age Limitations: Some insurers may have age restrictions, either refusing to insure older dogs or charging higher premiums for senior pets.

How Much Does Dog Insurance Cost?

The cost of dog insurance can vary based on a number of factors, including your dog’s breed, age, health history, and the level of coverage you choose. On average, dog insurance premiums range from $30 to $70 per month. However, the price can be influenced by:

Breed: Some dog breeds are more prone to specific health conditions, which may lead to higher premiums. For example, large dog breeds tend to have higher insurance costs because they are more likely to suffer from joint issues or other age-related conditions.

Age: Older dogs typically have higher premiums due to their increased likelihood of developing health problems.

Coverage Type: More comprehensive plans, including accident and illness or wellness coverage, will be more expensive than basic accident-only plans.

Location: Veterinary care costs can vary based on where you live, so premiums may be higher in regions with more expensive veterinary care.

Deductible and Reimbursement: Your deductible and the percentage of the bill reimbursed will also impact your monthly premium. Higher deductibles usually result in lower premiums, while higher reimbursement rates can increase your monthly cost.

How to Choose the Right Dog Insurance Plan

Choosing the right dog insurance plan can be challenging with so many options available. Here are some tips to help you make an informed decision:

Assess Your Dog’s Health: If your dog is young and healthy, an accident-only policy may be enough. However, if you have an older dog or one with pre-existing conditions, you may want to opt for more comprehensive coverage.

Compare Providers: Take time to compare different insurance companies. Look at their coverage options, exclusions, customer service, and pricing. Reviews from other pet owners can also provide valuable insight into how well a provider handles claims and customer support.

Understand the Fine Print: Read the policy details carefully to understand the exclusions, waiting periods, and any coverage limits. This will help you avoid any surprises when it comes time to file a claim.

Consider Your Budget: While it’s important to ensure your dog gets the best care, the cost of insurance should be manageable within your budget. Choose a plan that offers the right balance of coverage and affordability.

Look for Flexibility: Some insurers allow you to adjust your policy as your dog’s health needs change. Look for a provider that offers flexibility in coverage and policy upgrades.

Final Thoughts

Dog insurance can be a lifesaver for both you and your furry friend. With rising veterinary costs and the unpredictable nature of accidents and illnesses, having insurance helps ensure that you can provide your dog with the best care without financial stress. Whether you’re dealing with a sudden emergency or managing a chronic condition, dog insurance allows you to focus on your dog’s recovery rather than worrying about the costs.

If you haven’t already considered dog insurance, now might be the perfect time to start looking into the options available. With the right plan, you can give your dog the care they deserve while protecting your finances.

Have you already enrolled your dog in an insurance plan? Share your experience or ask any questions you may have in the comments below!